Australia’s Most Trusted Credit Repair Experts

The fast, affordable and effective way to fix my credit

Looking for

Debt Consolidation?

Clear Credit Solutions not only offers an award winning credit repair service in Australia but this service also includes debt consolidation and debt negotiation at no extra cost.

The benefits of using Clear Credit Solutions to help you with debt consolidation may include:

- negotiation with creditors for a reduced sum

- negotiation and offer of an affordable payment plan with creditors

- offer of freezing interest on any outstanding debts

- offer of consolidating outstanding payments into one lump sum

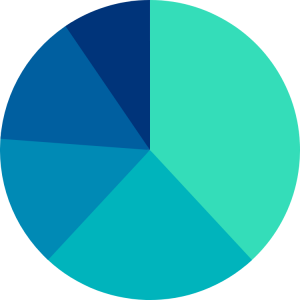

CREDIT REPAIR PROCESS IN AUSTRALIA

Includes our full refund policy

We do not charge any administration fees to investigate a copy of your credit report to see if we can help, we do this for free

We conduct our free investigation into your credit report to determine if it is something we can repair for you

If accepted, we only ever charge one set fee to clear your credit file of any and all defaults and negative listings. There is no charge per listing

If unsuccessful in helping to remove all of your defaults we accepted at the beginning, you will receive a full refund of our fee

Fast Bad Credit Restoration

In Australia

Welcome, we can help provide you with clear and simple solutions for bad credit repair in Australia.

We have a range of services to assist people who have had a credit default in the past.

Our services are there to assist people who would like to permanently clear and fix any black marks against their credit file.

Take advantage of our fast, efficient and simple credit fix solutions. We endeavour to help all our clients and provide them with a path to a brighter future that is free from defaults, allowing them to move forward in life and finances.

We provide a service which operates Australia wide, if you are serious about fixing your file and getting your credit clear, then your first step to a brighter future is a call to our credit file repair experts.

- We have helped countless Australians

- We provide same day consultancy

- Fees only apply once application has been

approved - What’s there to lose? You receive all of your

money back should we fail

- One set fee

- No hidden terms and conditions

- Full refund guarantee

Frequently Asked Questions

How can I improve my credit rating?

In order to improve your credit rating, you may need to remove negative listings /black marks from your credit report. These listings can only be removed if you are able to identify an error in the listing which our ‘audit masters here at Clear Credit Solutions specialize in.

Why is it important that I repair my credit rating?

It is important to repair your credit rating as this is most likely the reason stopping you from getting a loan approved. It will also save you thousands of dollars every year by allowing you to get loans at lower interest rates.

If I pay the default or negative listing, will it be removed?

Unfortunately, paying the listing will not remove it from your credit report file and does not mean that you will be able to get approved for finance in the future. A default/black mark stays on your file for 5-7 years unless it has been listed incorrectly.

How does my credit report affect me?

Your credit report is checked when you apply for credit. If you have a negative listing/default or even a court action on your credit report, you are highly likely to be declined for any finance application such as a loan or a phone plan.

The Credit Repair Industry

The Credit Repair Industry – What To Look For in a Repairer The goal of Australia’s credit repair industry is to assist consumers in improving

How to make better financial decisions. What impacts your Budget?

How to make better financial decisions. What impacts your Budget? Discover how Australians are managing the cost of living pressures through spending and saving strategies

Is your credit score impacted by Afterpay?

Is your credit score impacted by Afterpay? Australian customers are fond of “buy now, pay later” (BNPL) systems, and more and more physical and online

Type of Defaults

You Can Get Removed With Credit Repair

At Clear Credit Solutions we pride ourselves on our ability to fix bad credit anywhere in Australia. We offer versatility in dealing with any and all defaults, black marks and negative listings to clear credit history.

No matter whether it’s something as simple as a phone bill or complex as a mortgage, you can be assured we’ve helped someone just like you before. We help by clearing your default listing, increasing your credit score and allowing you to move forward with our affordable, simple service.

Book A Time

We have a skilled team of consultants awaiting to discuss any and all questions you may have about credit fix in Australia.

Please call 1300 789 783 so we can help you today! Alternatively fill out the enquiry form with a good time to reach you and we will give you a call.