How To Improve Your Equifax Score

Being declined for finance is not something anyone wishes to experience. Especially if it is near the end of the financial application process. Clear Credit Solutions is an award-winning service. We can help wipe credit clean so the headache of a declined financial application is not something that happens to you!

Credit defaults and court judgments are negative listings which impact your credit report. These things are what can cause financial applications to be declined and this is where Clear Credit Solutions is important. Discovering something negative on a credit file is not the end of the road because the next step is to call or email our friendly staff who can talk you through our clear credit process.

Not only does Clear Credit Solutions offer an award-winning service but also an extensive list of useful articles such as the one below.

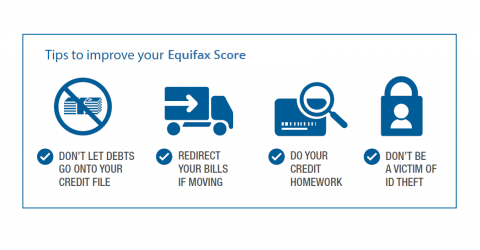

There are a number of ways you can improve your credit report and Equifax Score.

Make sure overdue debts aren’t recorded on your Equifax credit report

This can be done by paying loans and bills on time. For example, consider consolidating your debts in order to pay off any loans faster or to reduce fees associated with several individual loans. If you’re having trouble, consider talking to a financial counsellor or your credit provider to arrange a payment plan.

Moving house?

Get in touch with all your credit providers (banks, utilities, phone company, ISP, etc.) to make sure bills are redirected to your new address.

Do your homework before you apply for credit, and only apply for credit when you need it.

Making a number of applications for credit within a short space of time can reduce your Equifax Score and make you seem less attractive to credit providers.

Regularly check your Equifax credit report

Get a free copy of your credit report to help ensure no one uses your identity to obtain credit or to commit an identity crime. Or simply sign up to an Equifax Plus annual susbcription plan, which includes credit alerts that will update you when certain changes are made to your report.

It’s important to note that references to overdue debts are not removed from your file just because the debts have been cleared. They’ll still remain on your file for report for five years.

However, the relevant credit provider will update your credit file to reflect the fact that the debt is no longer overdue. For more information, see ‘How can I check my credit history?’