How Does My Equifax Score Impact My Credit Application

How Does My Equifax Score Impact My Credit Application?

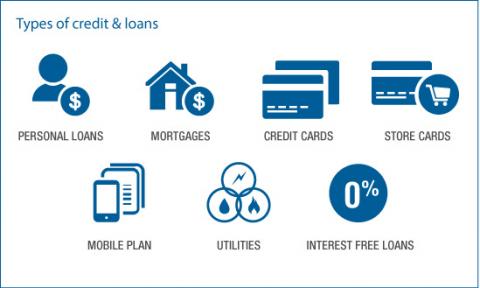

Your Equifax Score is a summary of your credit information held by Equifax and indicates how finance or utility providers may view you when you apply for credit. Credit scores are dynamic and change depending on when the score is generated and in what circumstances it is requested. Some lenders will use your credit report and Equifax Score, along with information on your application form or information they may have on you as an existing customer. The lender can assess all of this information against their own policies and lending criteria.

At Clear Credit Solutions we can help you get your credit file repair.

If you need assistance with this type of negative listing please call one of our credit report experts at Clear Credit Solutions on 1300 789 783 or if you fill in our enquiry form one of the team will give you a call today!